Video from Sales Tax Forum Live

The video from the Save Our Streets Sales Tax Forum on June 14 is live: The special ballot question will be put to city voters

The video from the Save Our Streets Sales Tax Forum on June 14 is live: The special ballot question will be put to city voters

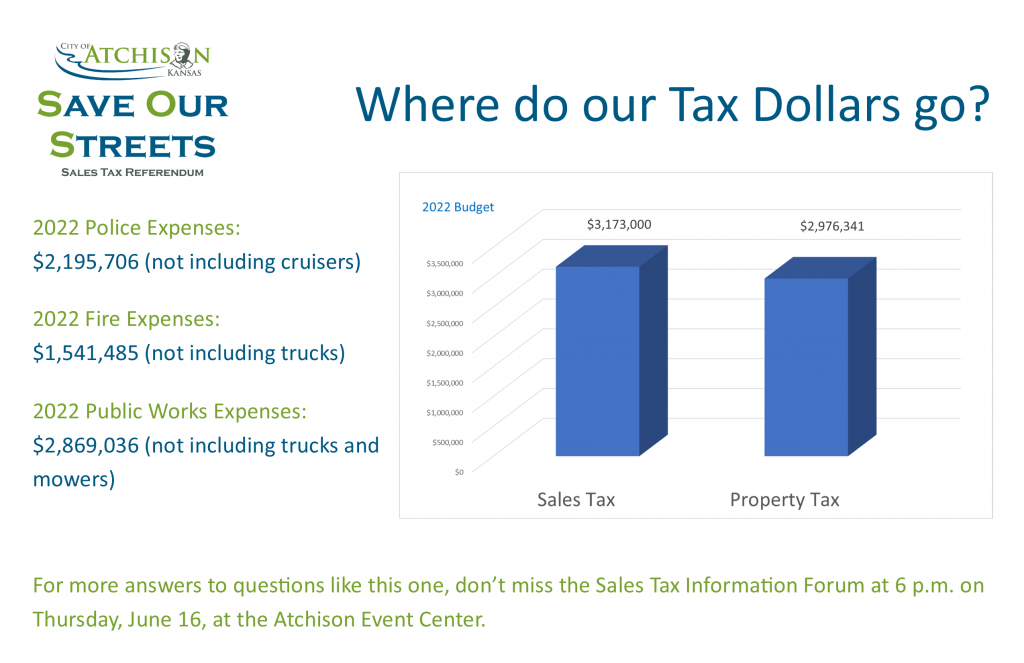

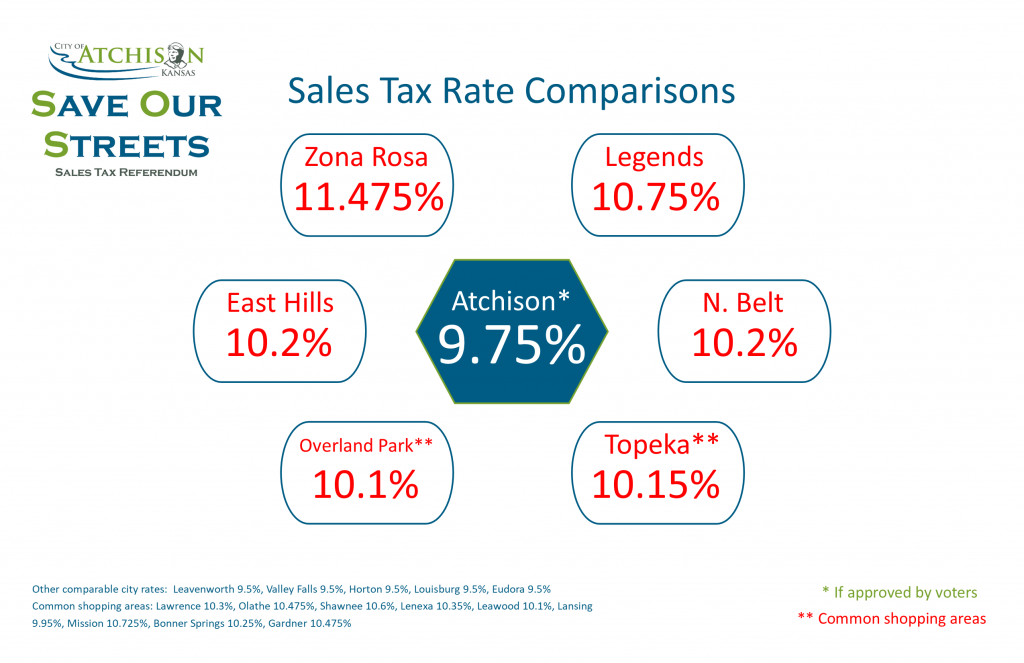

With the Save Our Streets Sales Tax Question by special ballot on Thursday, July 14, there has been some question as to where current City

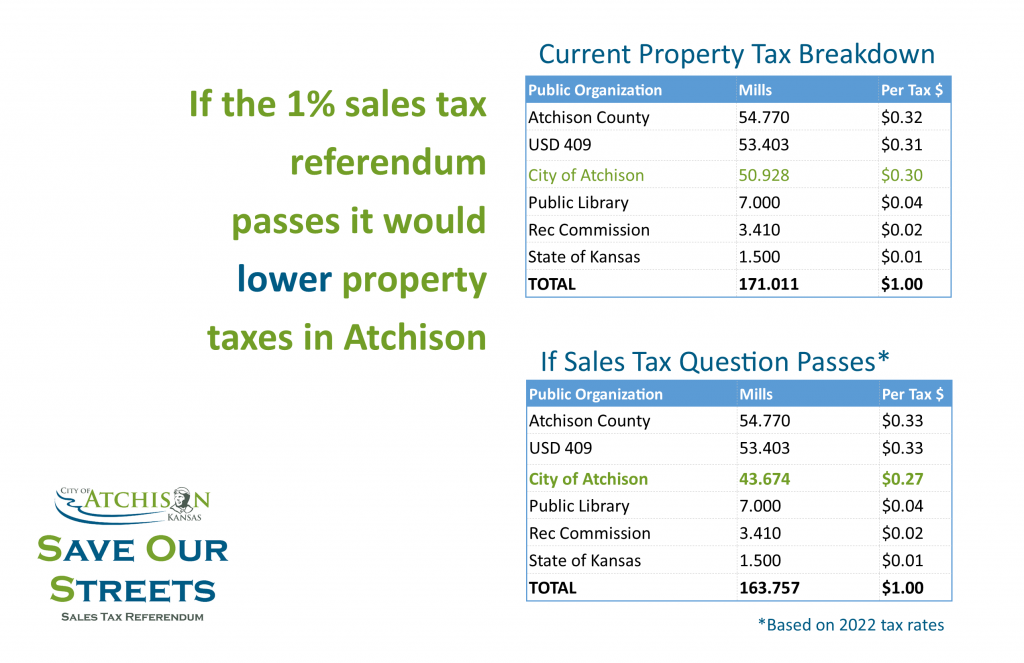

If voters approve the SOS – Save Our Streets Sales Tax Referendum in July, that would lead to a lowering of City property taxes (that

By approving a 1% sales tax for street infrastructure and property tax relief – residents would be lowering the amount they pay for property taxes:

How much will it cost for better streets and lower property taxes? Probably not as much as you would think.

How much is the proposed tax?

1.0% – which would add 1 penny to every retail dollar spent in the City of Atchison.

What is the money for?

The tax is for transportation infrastructure and property tax relief. Transportation infrastructure includes streets, curbs, sidewalks, and alleys.

There are two resolutions on Tuesday’s special meeting, what are they for?

One resolution is a legal calling for the referendum – making the question available for the public to vote on. The other resolution designates 75% of all revenue from the SOS Tax to transportation infrastructure – streets, sidewalks, curb, and alleys. The other 25% is designated to go toward property tax relief. That means the City’s portion of the mill levy will be lowered by an amount directly correlated to the money generated by the tax.

When would the tax take effect if it is passed and will it last forever?

The tax would go into effect on Jan. 1, 2023 and would sunset after 20 years.

Why this tax, now?

During the 2021 Community Survey, two of the biggest issues facing the community were identified as high property taxes and poor street and alley conditions:

During the 2021 Community Survey, only 21% of respondents were satisfied with streets and sidewalks overall and streets and sidewalks were identified as the second most important city service by residents (behind police). City streets and sidewalks were identified by 58% of respondents as having the greatest impact to improve the quality of their neighborhood – that was the highest response.

During the 2021 Community Survey, only 40% of respondents were satisfied with major city streets and curbs, and only 21% were satisfied with neighborhood streets and curbs. Only 11% were satisfied with alleys. Only 32% of respondents were opposed to a new sales tax to fund a higher level of service for transportation improvements. 45% supported a new tax, 22% were not sure.

In addition, high property taxes were the second most identified as having an impact on improving the quality of life in city neighborhoods and were considered the second biggest issue facing Atchison in the next five years behind Economic Development.